Exploring the digital transformation of billing and payments

How digital reminders, autopay and payment apps are reshaping consumer trust and behavior in an evolving financial ecosystem.

Highlights

- Digital reminders are essential – nearly four in five people receive them and a significant majority appreciate them

- Consumers trust digital payment options over physical methods, with autopay, apps and websites leading the way

- Autopay is among the most used, most trusted bill pay methods for consumers, especially when it comes to fixed bills like subscriptions and insurance

- Payment apps are now used far more than cash/checks for P2P transactions, with consumers valuing their convenience and speed

- Consumers remain optimistic despite economic uncertainty, and 40% expect to be doing better a year from now

Consumers value digital reminders

The variety and complexity of bills have expanded, transforming how people manage and prioritize their finances. Digital reminders have emerged as a critical element to keep consumers organized in their billing.

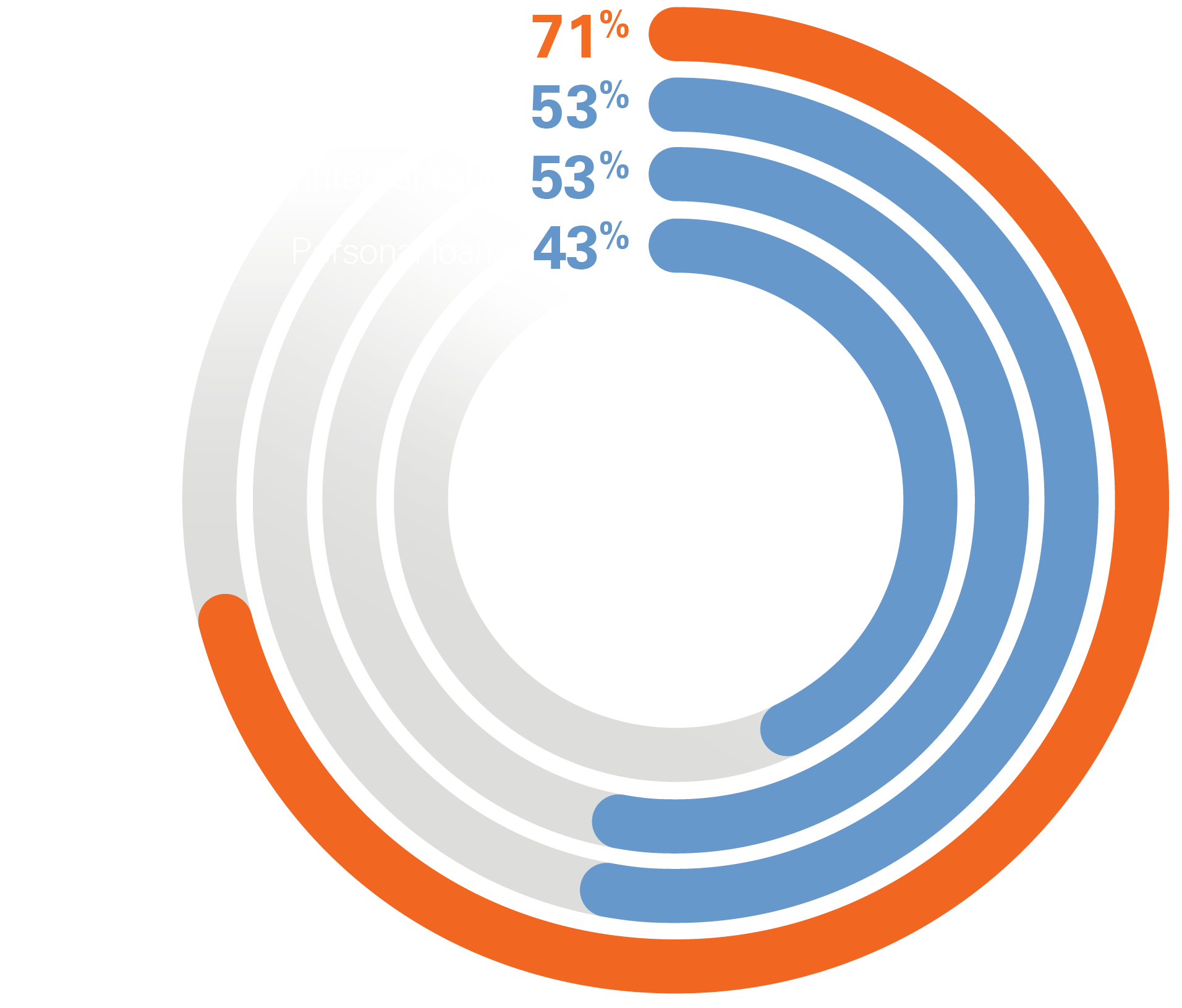

Trust in digital payment methods surpasses in person

Consumers trust digital payments more than traditional channels like in-person, mail and email that could be intercepted.

Trust in payment methods

Autopay

65%

Biller's app/website

61%

Bank/credit union website

57%

In person

43%

24%

24%

Phone call

21%

For eight in ten consumers, autopay is the go-to for convenience and reliability

Bills paid with autopay

Reasons to use autopay

Payment apps are the most used method to pay another person

Payment apps are rapidly overtaking traditional methods, including cash and checks, driven by consumer demand for convenience and speed.

- How we’re paying each other

- Why payment apps

- Barriers to app use

Consumer financial expectations remain positive despite economic concerns

While inflation and economic uncertainty continue to dominate the news, consumers remain optimistic about their financial outlooks.