Cards, Credit and Consumer Control

Consumers are looking for tools and information that give them control over their financial lives. That influences everything from top-of-wallet card choice and mobile money movement to third-party tools and fraud prevention.

Highlights

Cards are the preferred way to pay

The path to top of wallet? Rewards

Consumers are taking control

People want hybrid everything

Cards are the preferred way to pay

The path to top of wallet? Rewards

Consumers are taking control

People want hybrid everything

Cards are preferred, by far

For all purchase types we asked about, most consumers prefer to use cards over cash, checks, mobile payments, or buy now, pay later (BNPL).

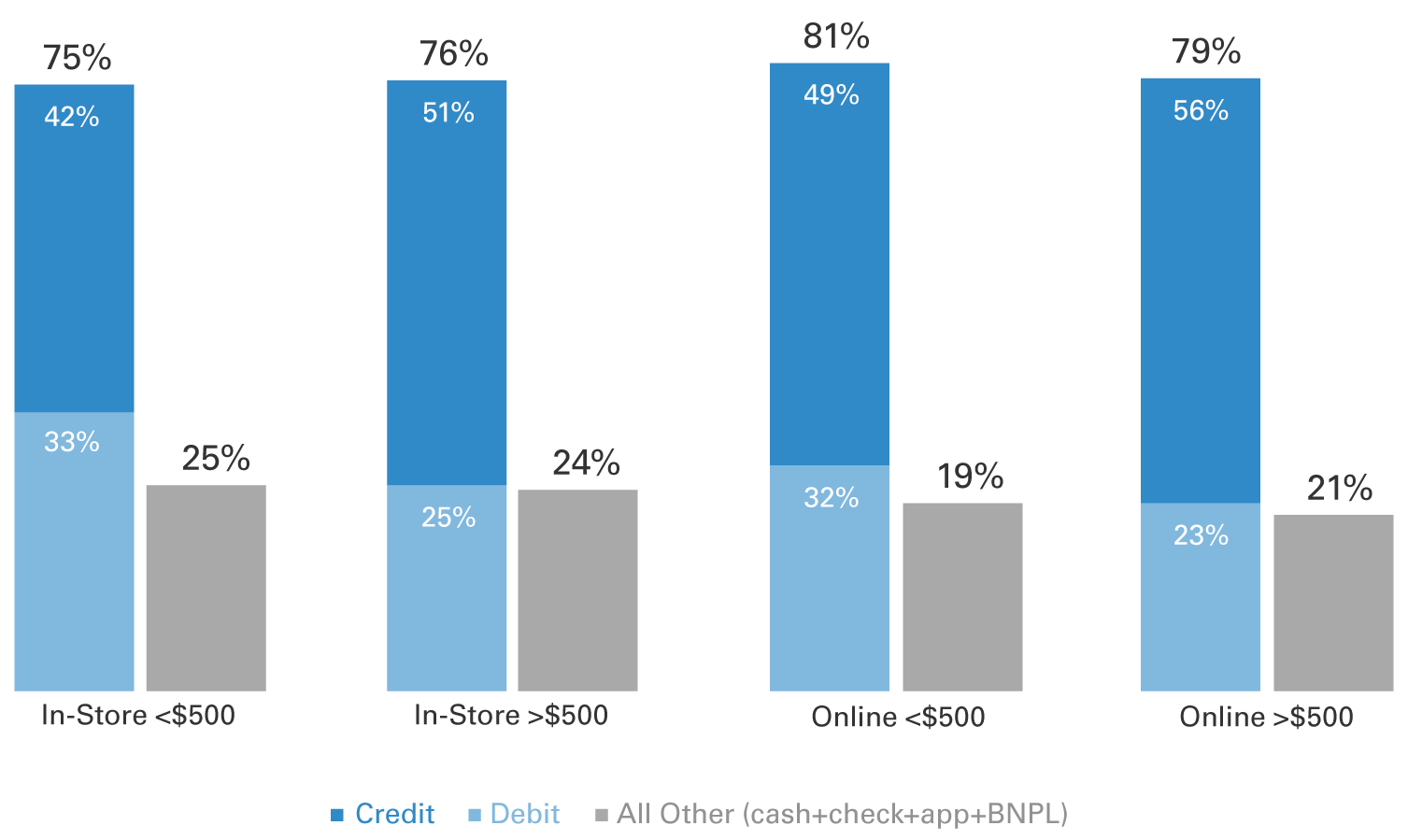

choose credit for big-ticket items (over $500) in store.

choose credit for big-ticket items (over $500) in store.

Payment Preferences by Channel and Amount

Gen Z prefers debit for large purchases – 46% in-store and 49% online, compared to 25% and 23% overall.

Perceptions of payment types

Whether contactless or chip-enabled, credit and debit cards continue to dominate in terms of perceived speed, ease and preference.

What do people say is

Fastest?

Fastest

Tapping a contactless-enabled credit or debit card

What do people say is

Most Convenient, Most Preferred?

Most Convenient, Most Preferred

Inserting my credit or debit card into a chip reader

What do people say is

Most Secure?

Most Secure

Using cash

What do people say is

Least Preferred?

Least Preferred

Paying by check

Rewards move cards to top of wallet

90%

have a go-to card they use most often

71%

choose their card to accumulate rewards points

40%

of people making $150K+/year pick their cards for the rewards

29%

choose a card based on rewards (among those with multiple cards who use only one)

- Tools and tech

- Alerts

- Money management

- Wanted: options