What do consumers think about their financial future?

How merchants and financial services providers can adapt in response to consumers’ experiences with personal finances, fraud protection and financial technology.

Highlights

- Optimism abounds among Gen Z and millennials who are more likely to say they’ll be better off financially in the next 12 months versus Gen X and boomers

- Credit cards are the preferred method of payment for everyday groceries and unplanned purchases of $500 or $2,500

- Fraud is a reality for most consumers, with 74% of consumers having been notified of breaches and unauthorized transactions while 29% have experienced high-cost fraud events, including account openings and stolen identities

- Seven in ten consumers use mobile to conduct day-to-day banking transactions and more than half like the idea of a financial super-app that can bring together all their financial accounts, learn their financial priorities and habits, and guide them with tailored advice and offers

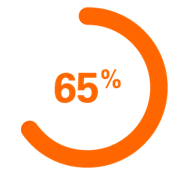

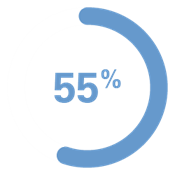

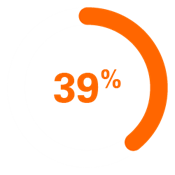

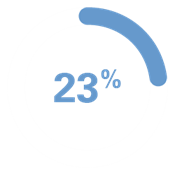

Optimism abounds among Gen Z and millennials

A respondent’s generational cohort strongly influences how they view their financial future, with younger cohorts believing they’ll be better off 12 months from now.

GEN Z

MILLENNIALS

GEN X

BOOMERS

What's influencing people's optimism?

Positive changes in income

Gen Z 56%

Millennials 53%

Gen X 52%

Boomers 65%

Positive changes in routine expenses

Gen Z 31%

Millennials 42%

Gen X 25%

Boomers 25%

Positive changes in employment

Gen Z 32%

Millennials 25%

Gen X 17%

Boomers 9%

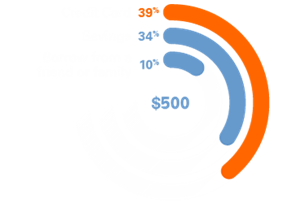

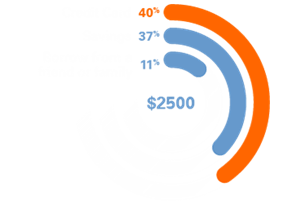

It could be for rewards, points or easier money management – credit cards are the preferred method of payment.

Whether for everyday shopping or unplanned purchases, consumers prefer credit cards over other payment options.

Routine grocery shopping

Unplanned purchases

Fraud is a reality for most consumers

Notified of fraud or attempted fraud

Someone put an unauthorized transaction on my card account 59%

Received collection calls for expenses you didn’t authorize 26%

Info compromised in a data breach 59%

Experienced identity and account fraud

18% Fraudulent account opened using my info

19% Someone changed my account information

11% Had my SSN stolen & used

Seven in ten consumers use mobile to conduct day-to-day banking transactions and more than half like the idea of a financial super‑app

Mobile banking continues to impact how consumers conduct everyday transactions. Click on the plus signs for more insights on how consumers are moving and managing money.

Person-to-person payment apps are becoming the norm. More than three-quarters of people use them, including 42% in the past week and 60% in the past month.

Mobile wallet use has increased steadily with nearly half using the technology at some point. Meanwhile, more than one-third (37%) of consumers have used them in the past 30 days.

Among all consumers, debit and credit cards are seen as the more convenient and secure forms of payment, while person-to-person payment platforms rank highly on convenience.

With this in mind, we asked consumers what they would think about a financial super-app that:

Helps with all your banking, payment, investment and savings activities.

Brings together all your accounts, from checking, savings, cards, loans, investments, etc., to enable you to achieve your financial goals.

Learns your financial priorities, spending and saving habits.

Supports you with bill alerts, automated payments, routine purchases you authorize.

Guides you with tailored advice and offers.

More than half of consumers like the idea of a super-app

What consumers have to say about a financial super‑app

Gives a well-rounded look with all accounts gathered in one place.

Too much information in one place. If anything happens to it, then everything is gone.

Everything bundled in one so access to monitor and see all different funds.

I also don't want the computer learning my spending habits. I find it creepy.

I like that it gives you advice and learns your spending habits and activities. Supports your billing payments and alerts.