AI, payments innovation and the shifting financial ecosystem

What merchants and financial service providers need to know about AI and evolving financial experiences to better meet consumers’ needs.

Highlights

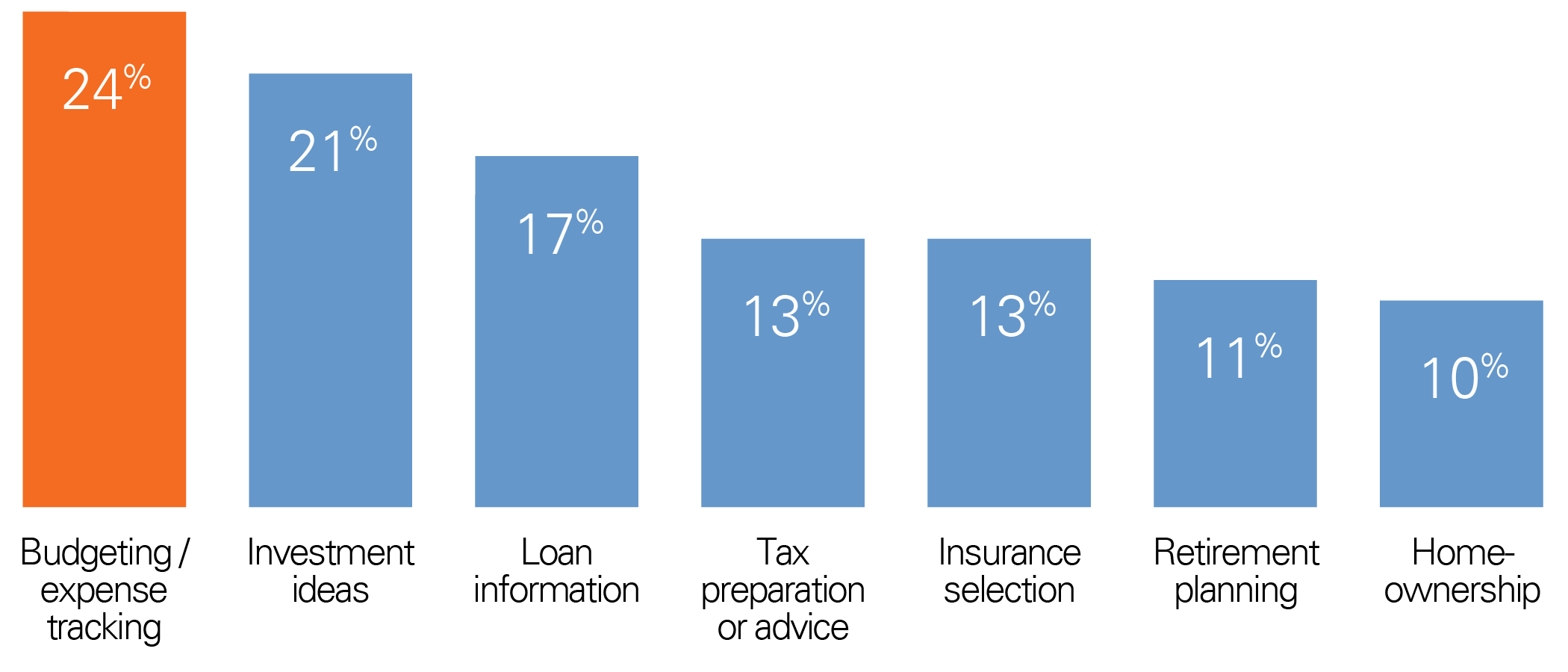

- Consumers are using conversational and generative AI to handle a variety of situations, including gaining insights into and managing their finances

- Debit cards are king, being used more than 1/3 of the days each month, but payments like mobile wallets and P2P are also leveling up with consumers

- Rates and rewards motivate consumers on which credit card to use, and when it comes to switching, 40% did so due to cash-back offers and 35% for better interest rates

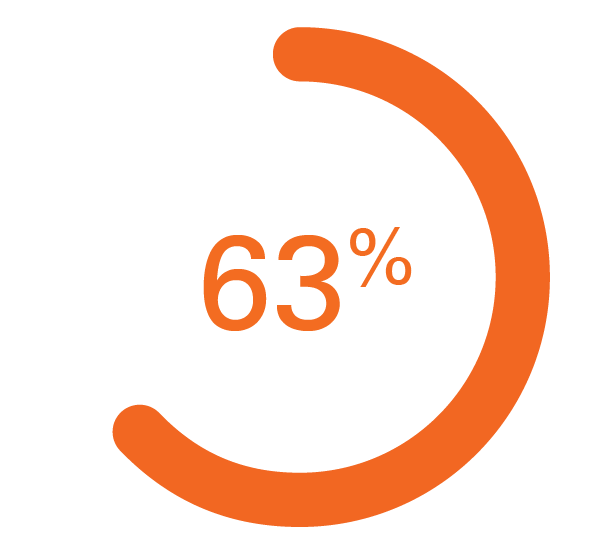

- Over 60% of consumers consider their financial situation to be the same or better compared to 12 months ago with income and expense changes as the top catalysts

Increase in AI adoption means increasing opportunities for financial service providers

As conversational (55%) and generative (32%) AI adoption continues to grow among consumers, many are realizing the benefits it brings to managing their finances.

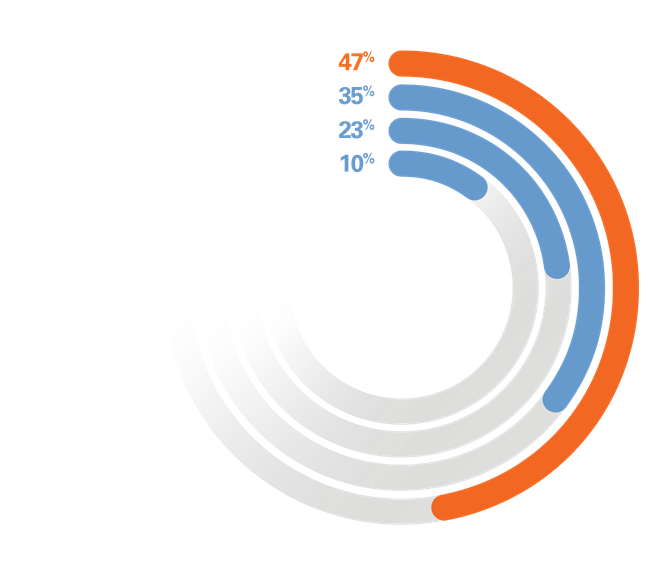

Consumers’ generative AI financial uses

Even though interest and engagement with AI is strong, opportunity remains to improve comfort with financial institutions integrating AI into banking activities with 41% not comfortable with any AI-based banking tools.

Comfort with AI-based banking activities

Despite AI adoption, concerns remain

For many consumers, their biggest fears of AI mirror prior emerging technology trends over the past decade.

Security and privacy

Accuracy

Losing personal touch

Potential for bias

What do consumers have to say about AI helping them with their finances?

Gives a well-rounded look with all accounts gathered in one place.

AI helped me figure out a good amount to put into a savings account.

Satisfied with basic information. Security issues are a concern.

Consumers have their payment preferences for everyday purchases

Not all payment options are created equal. Debit, credit and cash are the methods consumers use most often while P2P and digital wallets have gained traction. And, while 37% of consumers have used checks and 13% have used BNPL in the past month, neither of those methods is among those consumers turn to most.

Most used payment methods

42% Debit card

26% Credit card

14% Cash

6% P2P

5% Mobile wallet

1% Check

Looking at the current state of credit cards

- How cards are being used

- Choosing the right card

- Why switch cards?

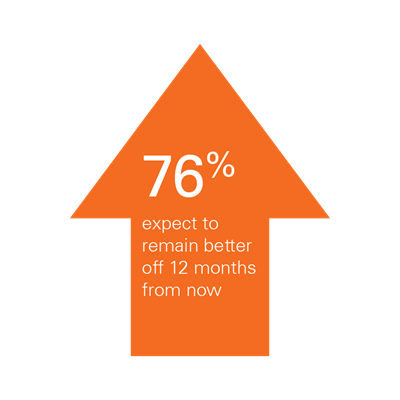

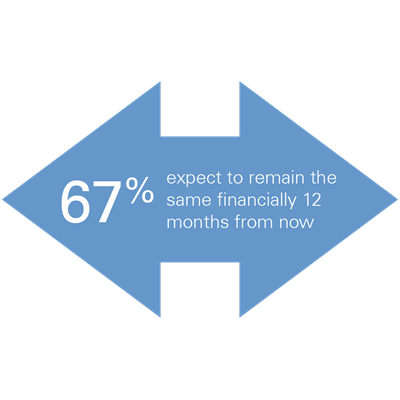

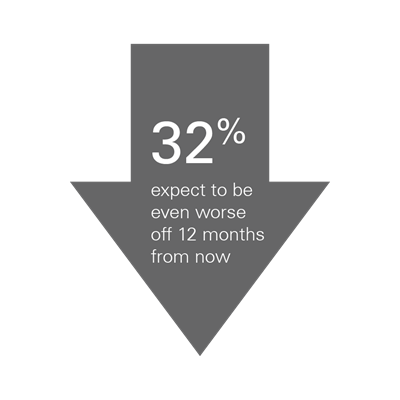

Consumers remain consistent with their financial outlook

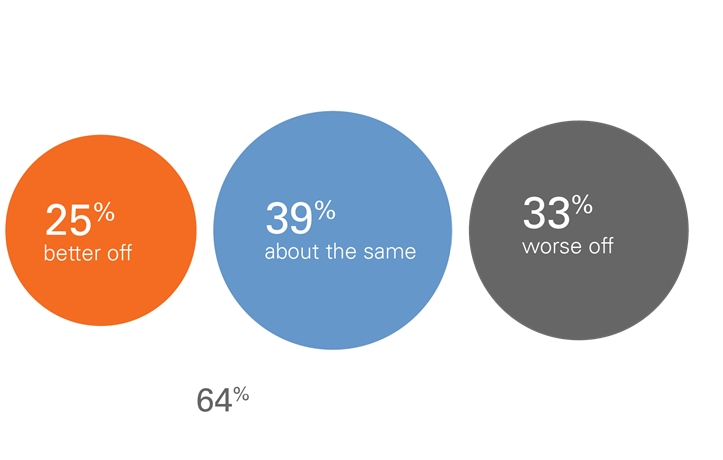

Ask consumers about their current financial situation compared to a year ago and you’ll find that, despite inflation and rising interest rates, only one in three feel worse off.

What is driving these changes?

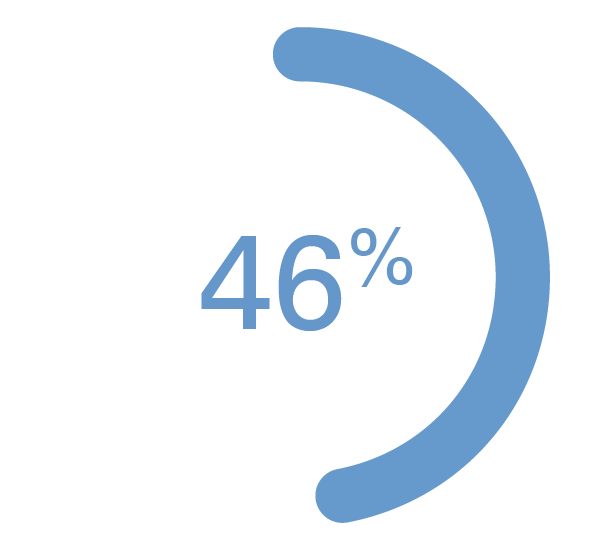

Among those better off versus those worse off, the impact of changes to income and major non-routine expenses is clear.

Those better off

Income change 52%

Major non-routine expenses change 10%

Employment change 20%

Routine expense change 27%

Family structure change 17%

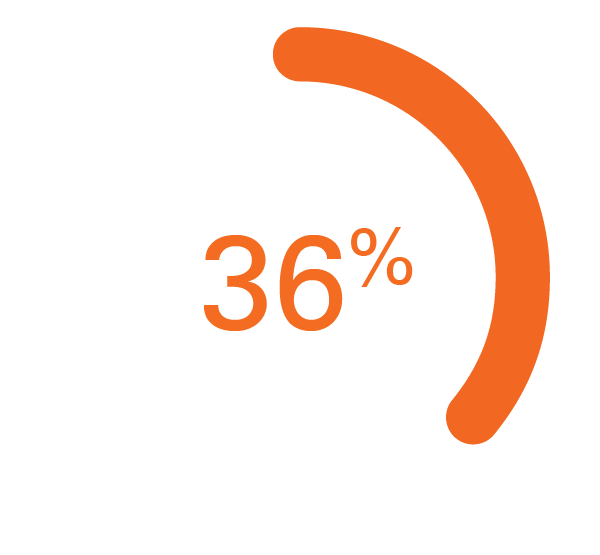

Those worse off

30% Income change

20% Major non-routine expenses change

25% Employment change

28% Routine expense change

16% Family structure change

Even more impressive is how consumers are using their current financial outlook to drive their views on the future. Specifically, most consumers are showing a direct correlation between how they have fared over the last 12 months and how that impacts where they expect they will be 12 months from now.