Fintech Adoption

Whether it’s filling gaps in available financial services or accessing convenient mobile options, consumers increasingly turn to fintechs to round out their financial experience.

Highlights

Our 2021 research looks at consumers’ relationships with fintechs. For purposes of this survey, we define “fintechs” as third-party apps or websites not affiliated with a bank or credit union.

Digital use increases fintech relevance

Fintechs fill gaps

Data sharing concerns some people

Fintechs are part of the financial experience

Digital use increases fintech relevance

Fintechs fill gaps

Data sharing concerns some people

Fintechs are part of the financial experience

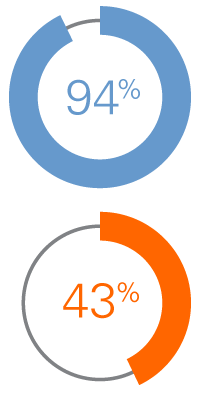

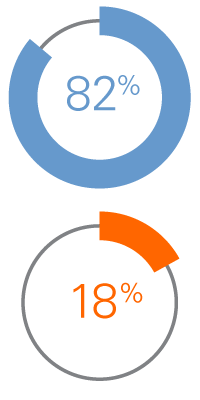

40 and under would stay with their bank if it went all digital, compared with only 47% of people over 40.

40 and under would stay with their bank if it went all digital, compared with only 47% of people over 40.

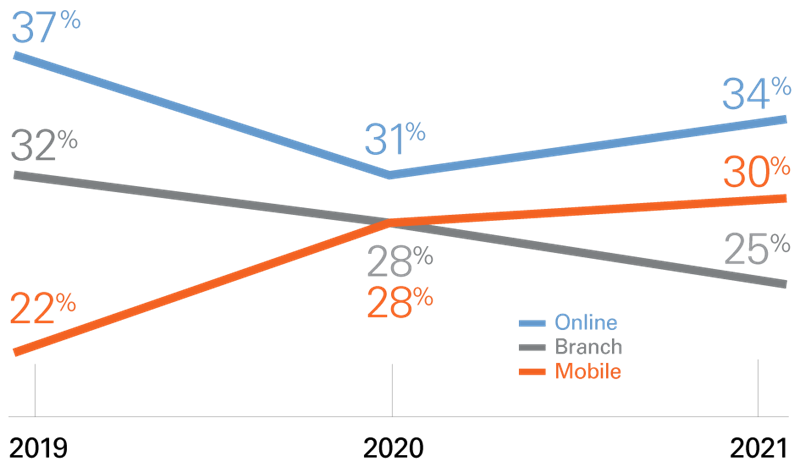

More people prefer mobile and online over in-person methods for interacting with their primary financial organizations. A majority would stay with a bank that went all digital.

For Banking, Mobile Now Preferred Over In-Person Interactions

Preferred Ways to Interact With Primary Financial Organization

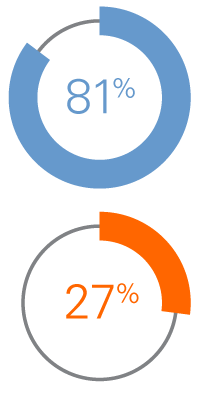

People 40 and under prefer digital (mobile and online) over the branch by nearly 6:1.

Awareness Is High for Some Types of Fintech Apps

Payment

Budget

Loan

Investment

Crypto

Payment

Budget

Loan

Investment

Crypto

Filling Gaps

Crypto in Focus

Data Sharing

Open to Fintechs

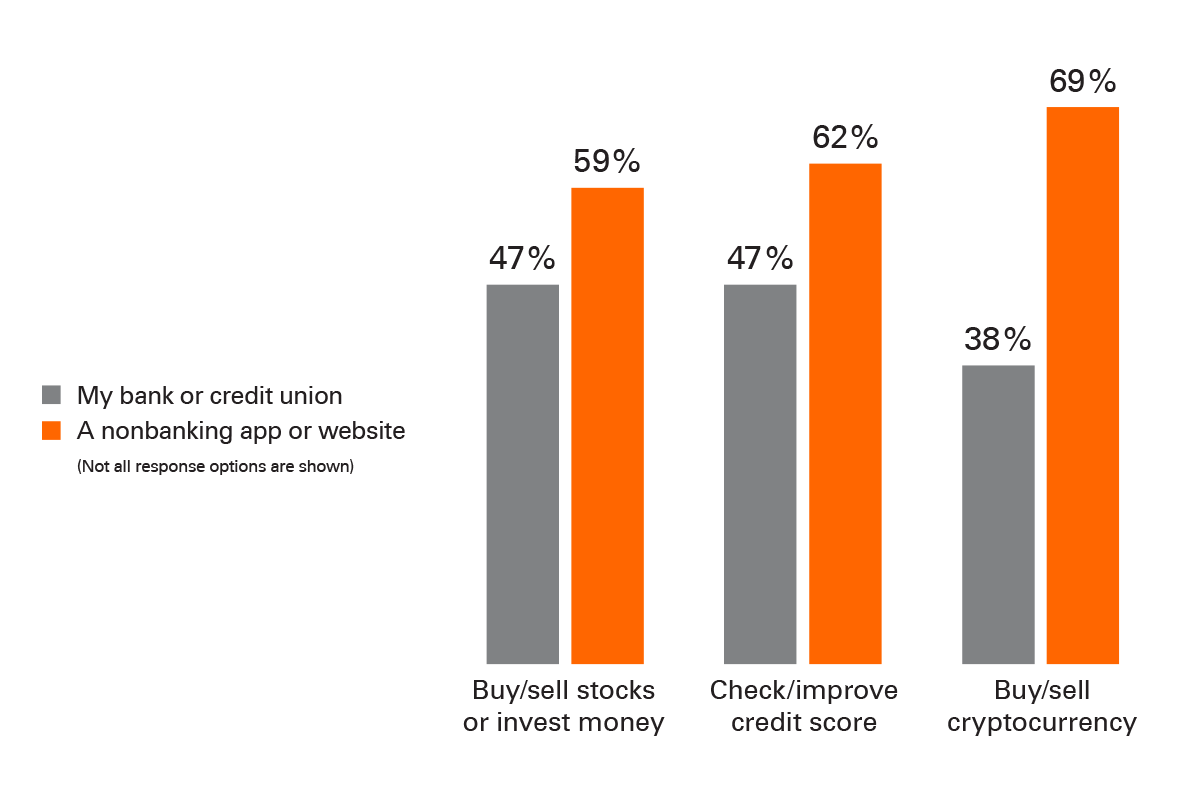

Fintechs fill gaps

Filling Gaps

Crypto in Focus

Data Sharing

Open to Fintechs

Crypto at the forefront

Filling Gaps

Crypto in Focus

Data Sharing

Open to Fintechs

Sharing financial information

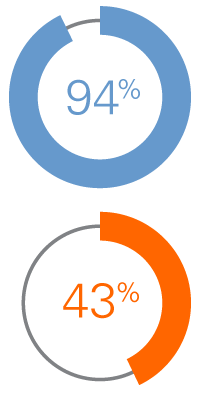

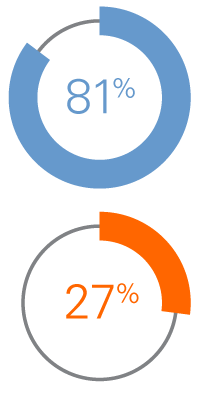

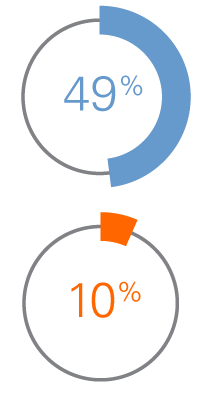

Connecting financial account information is essential for many fintech services. But people are split on whether they’re likely to do it. The big difference maker? Age.

Only 35% of people 56 and under said they would be unwilling to share data, compared with 72% of people over age 56.

Filling Gaps

Crypto in Focus

Data Sharing

Open to Fintechs

How Many Would Use a Fintech?

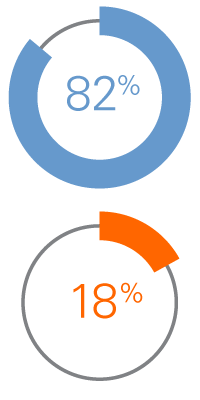

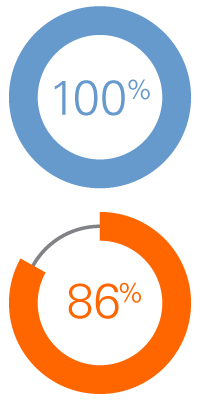

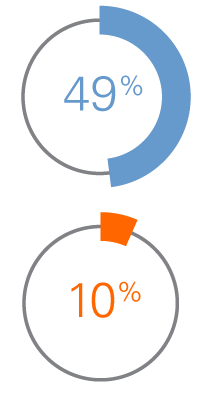

People are open to fintechs

Consumers are willing to turn to fintechs for a wide variety of services as part of their overall financial experience.

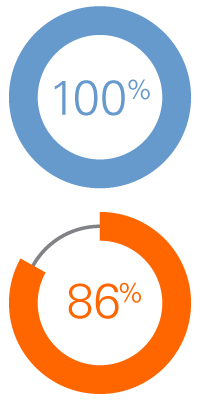

Most people use at least one type of fintech service – 86% use a payment app, for example – and awareness of different fintech services is high.