- About Enteract

- 1. Unify Customer Data

- 2. Enable Proactive Outreach

- 3. Accelerate Your Sales Cycle

This CRM solution can help you accelerate sales for your financial institution while improving your customers’ experiences.

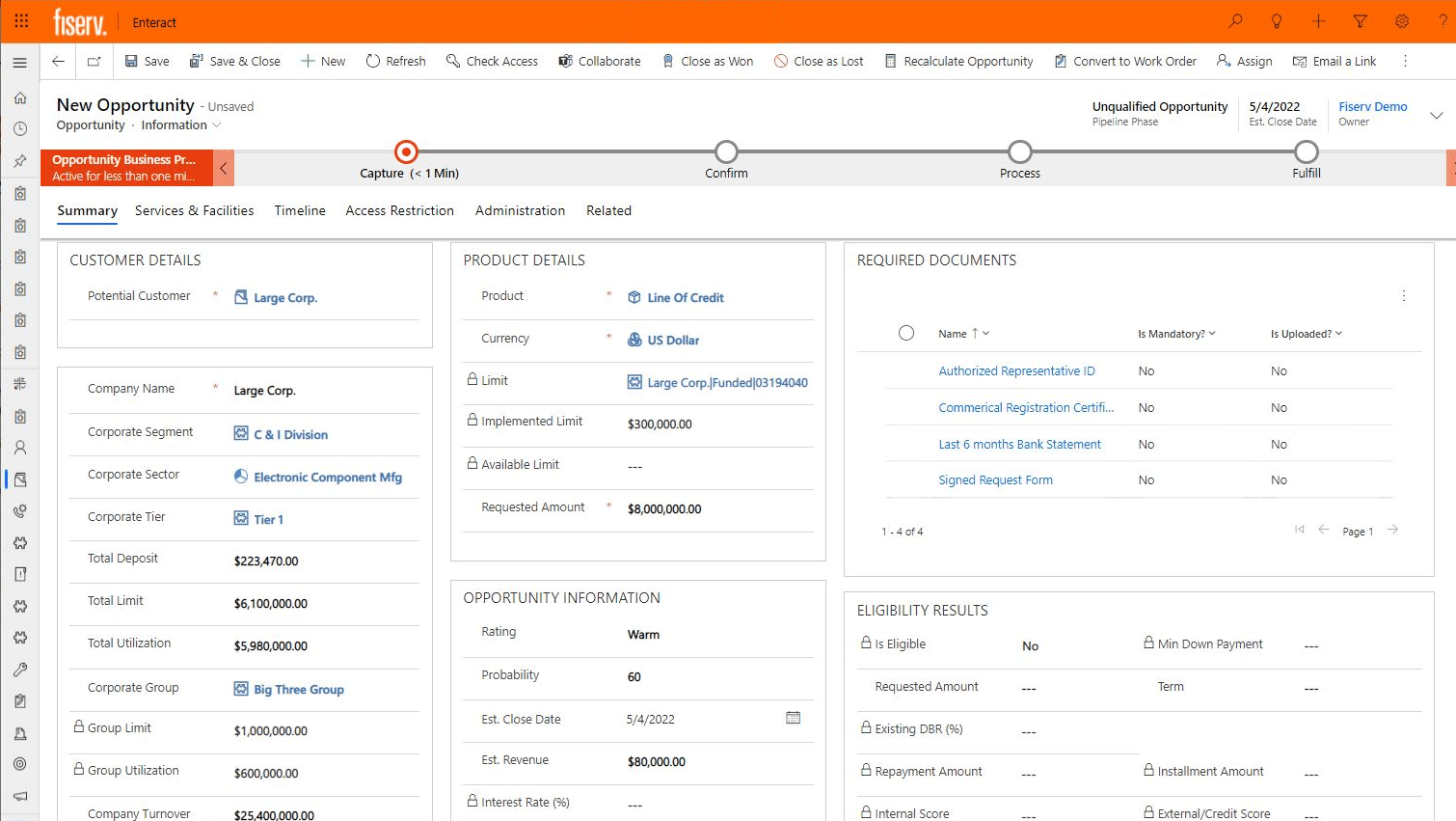

Enteract is designed to support the unique needs of commercial and retail banking that includes easy access to valuable customer data.

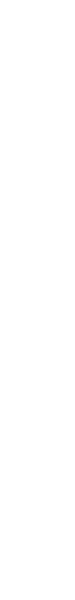

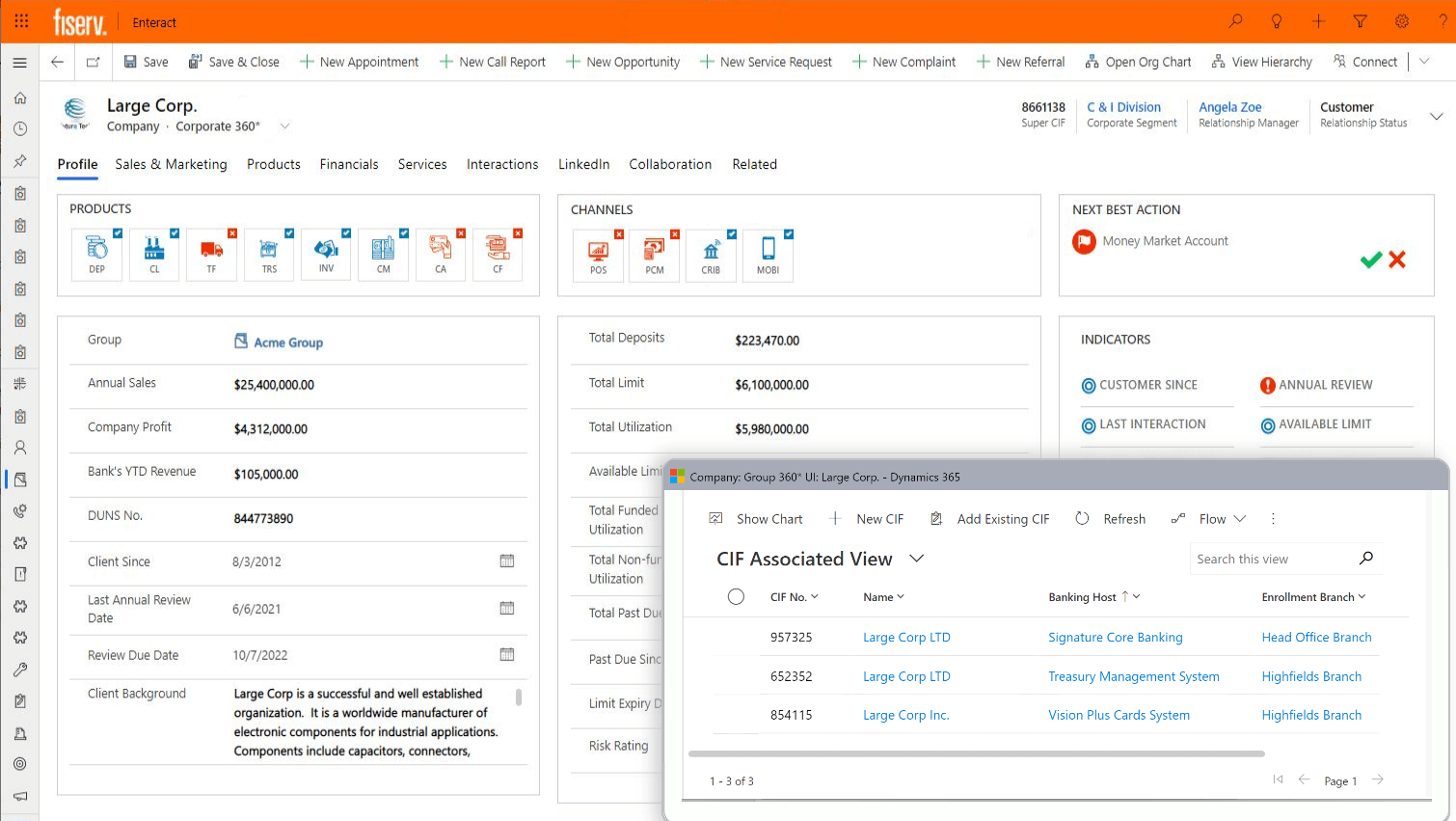

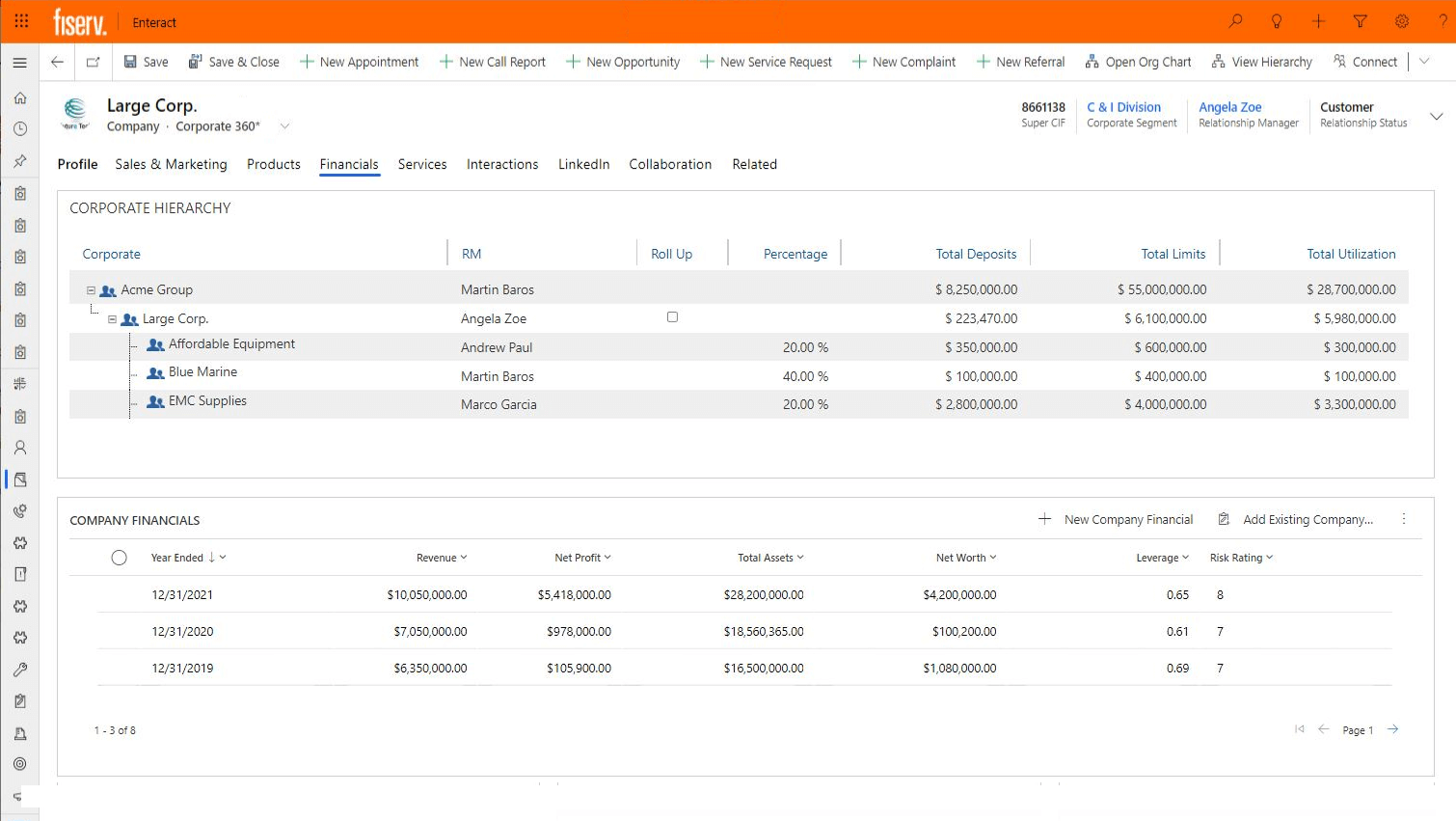

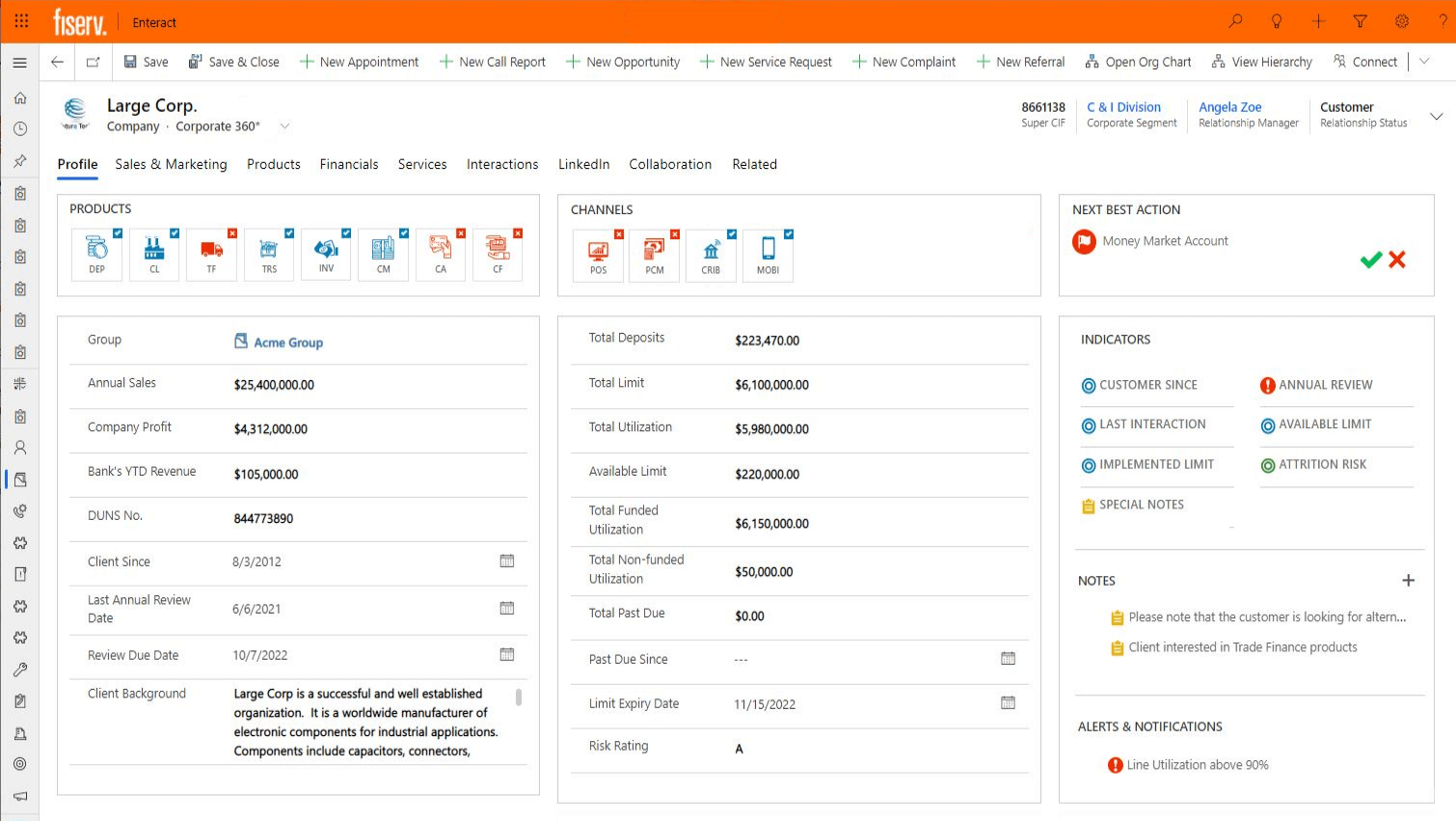

View customer profile and financial data in one simple view

This aggregated view is created with data extracts from disparate systems where your clients' account information resides, giving bankers one place to view everything.

Easily see key financial metrics for each customer and household

Banking systems are complex but seeing your customer relationships on a single pane shouldn’t be. With Enteract® from Fiserv, complex relationship and financial data is distilled into easy-to-see icons, indicators and relationship trees. Time-sensitive information is presented in real-time, preventing switching screens and accessing multiple systems.

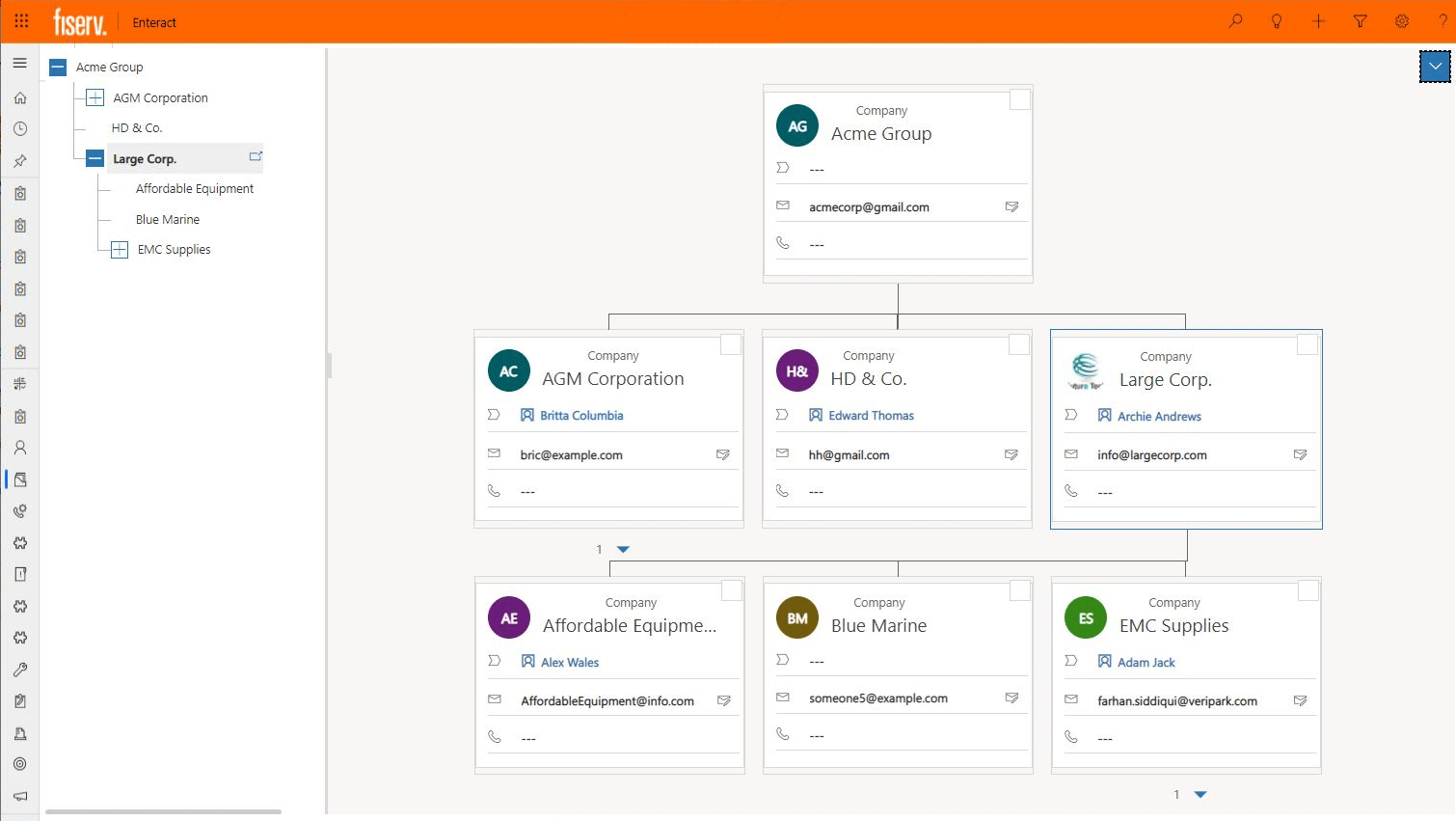

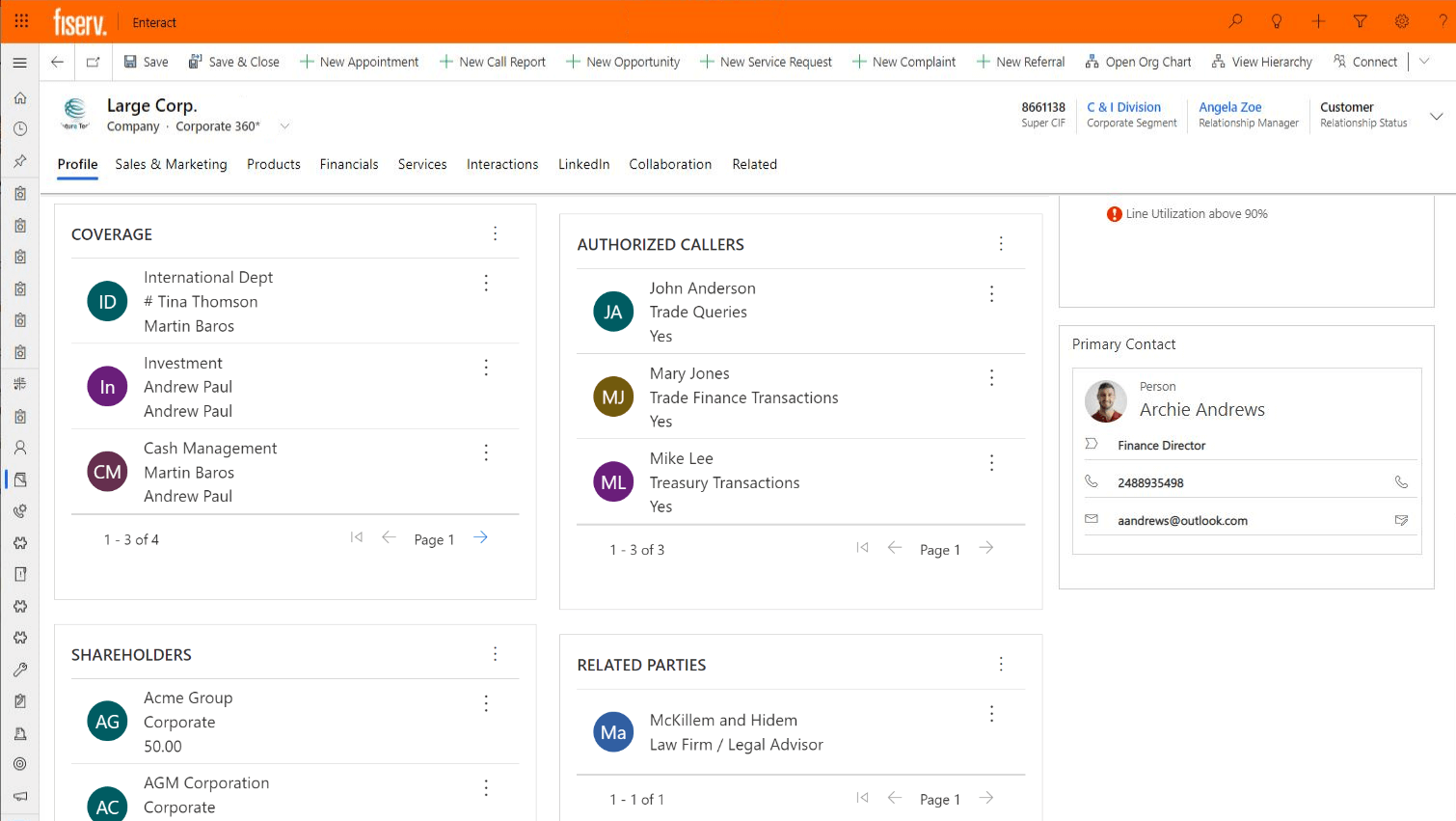

View complex customer relationships at multiple levels

An easy-to-read hierarchy helps relationship managers see the entire relationship and understand ownership, deposits or loan utilization of each account.

Access insights quickly

Our simple tiled hierarchy can be customized to show the things that are meaningful about your clients, such as industry, number of employees and annual revenue.

See the whole customer relationship

Including all related people and companies, even if they don’t have an account at your financial institution. Centers of influence and suppliers can be added to Enteract to show an even more complete picture of customer relationships.

Click on the Enable Proactive Outreach tab above to continue exploring Enteract.

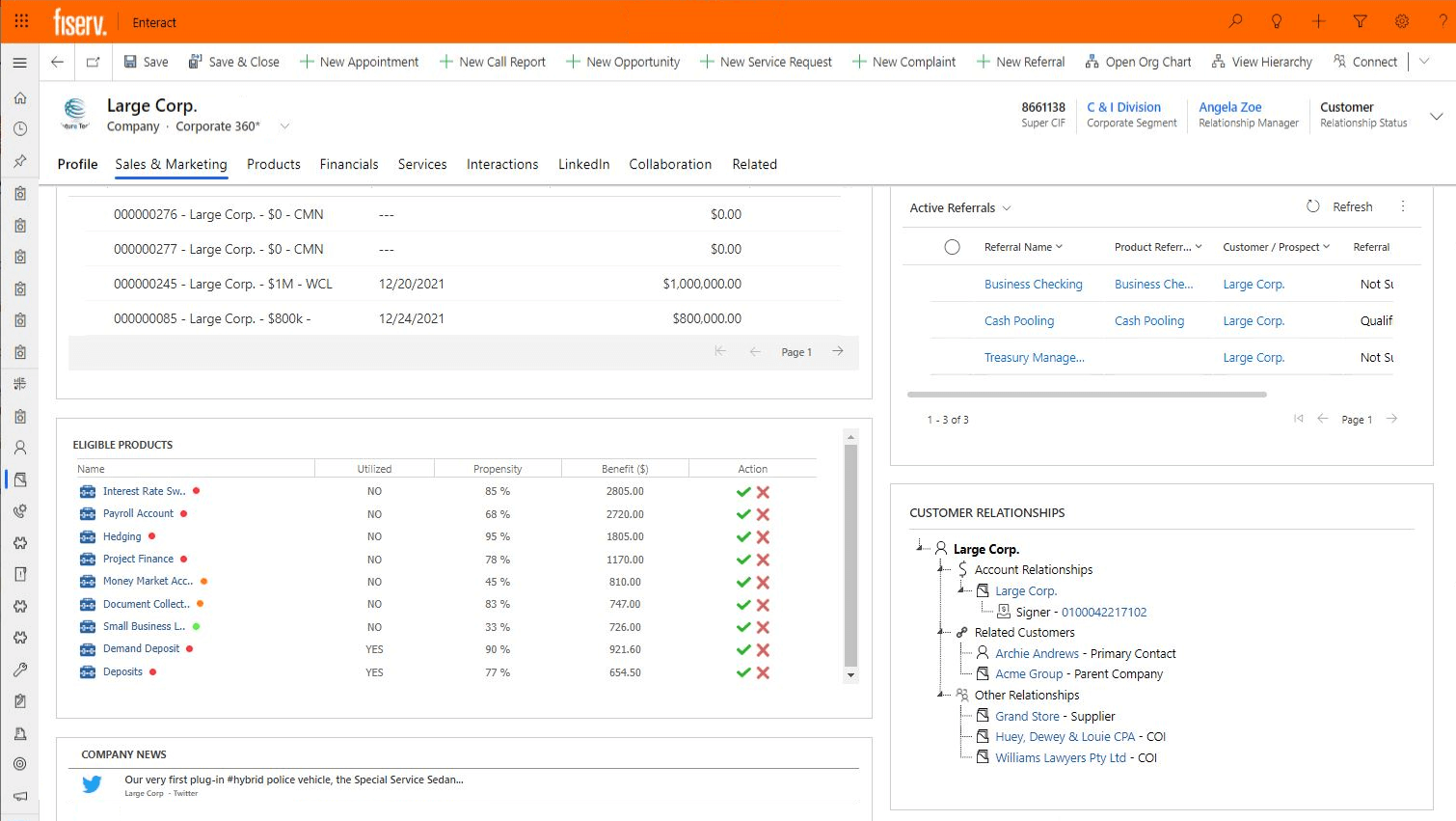

Access prospect and customer lists through a single digital workspace

This gives bankers insights on where to focus their time and attention. You will be able to set standards for minimum effective client and prospect outreach, facilitating meaningful client follow up. Your bankers will know how and when to take action, ensuring regular interactions with your most valuable customers.

Review customer profile and key indicators

By leveraging key indicators, system generated alerts, insights and recommendations, bankers will have insights into meaningful discussions you can have, and when to reach out to a client.

Create opportunities by enabling team selling

Bankers can bring in colleagues and teams or individuals from other lines of business to maximize the power of the bank’s human capital, broadening and deepening client relationships.

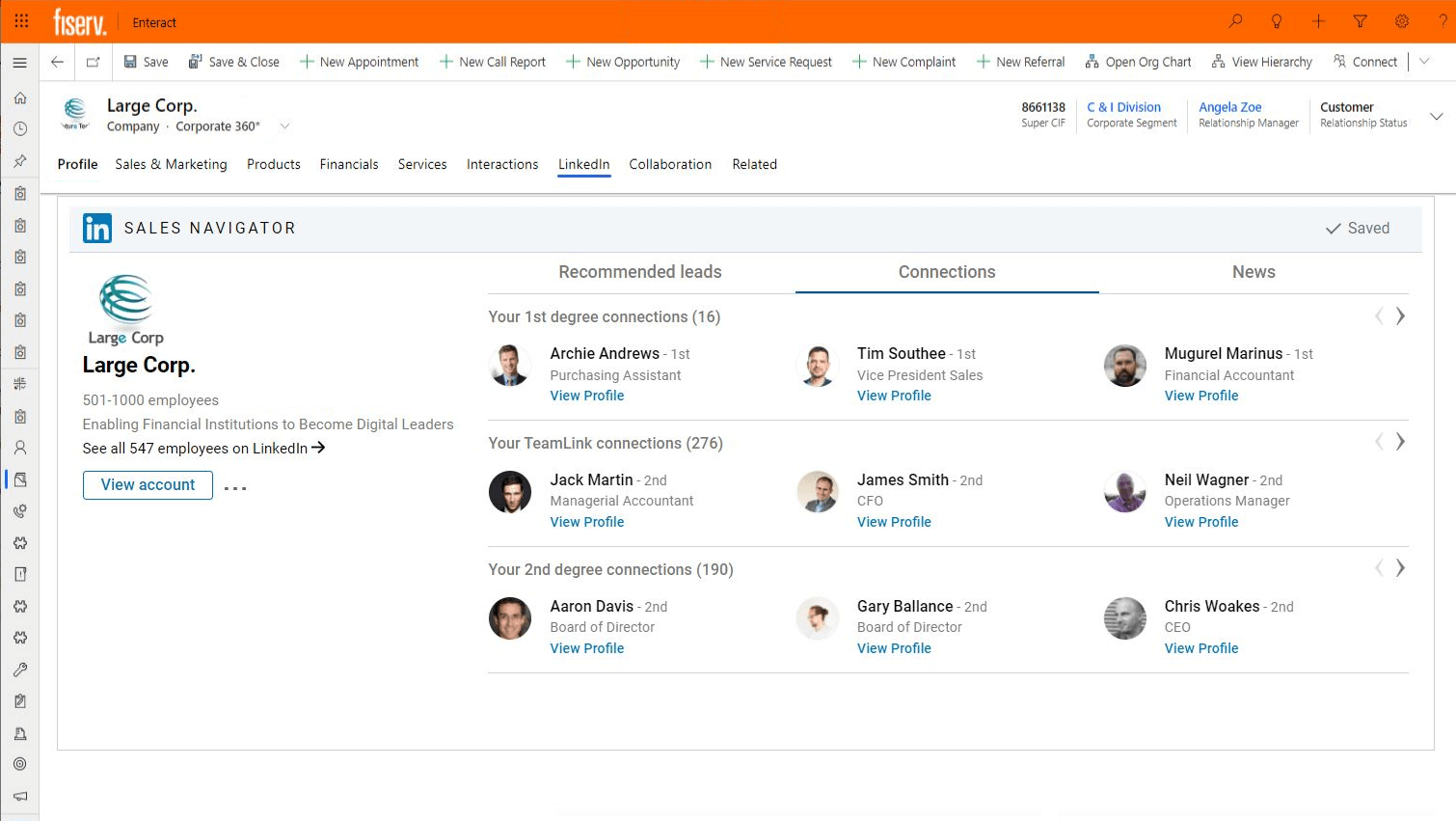

Reduce research time by easily linking related data sources to bring client-related data to bankers

Gain customer and prospect insights with a news alert for each of your customers and deep integration with LinkedIn Sales Navigator. See the details of your customers’ relationships with your financial institution, but also understand and leverage integrations with social media platforms like LinkedIn and subscribe to RSS feeds on customers and prospects.

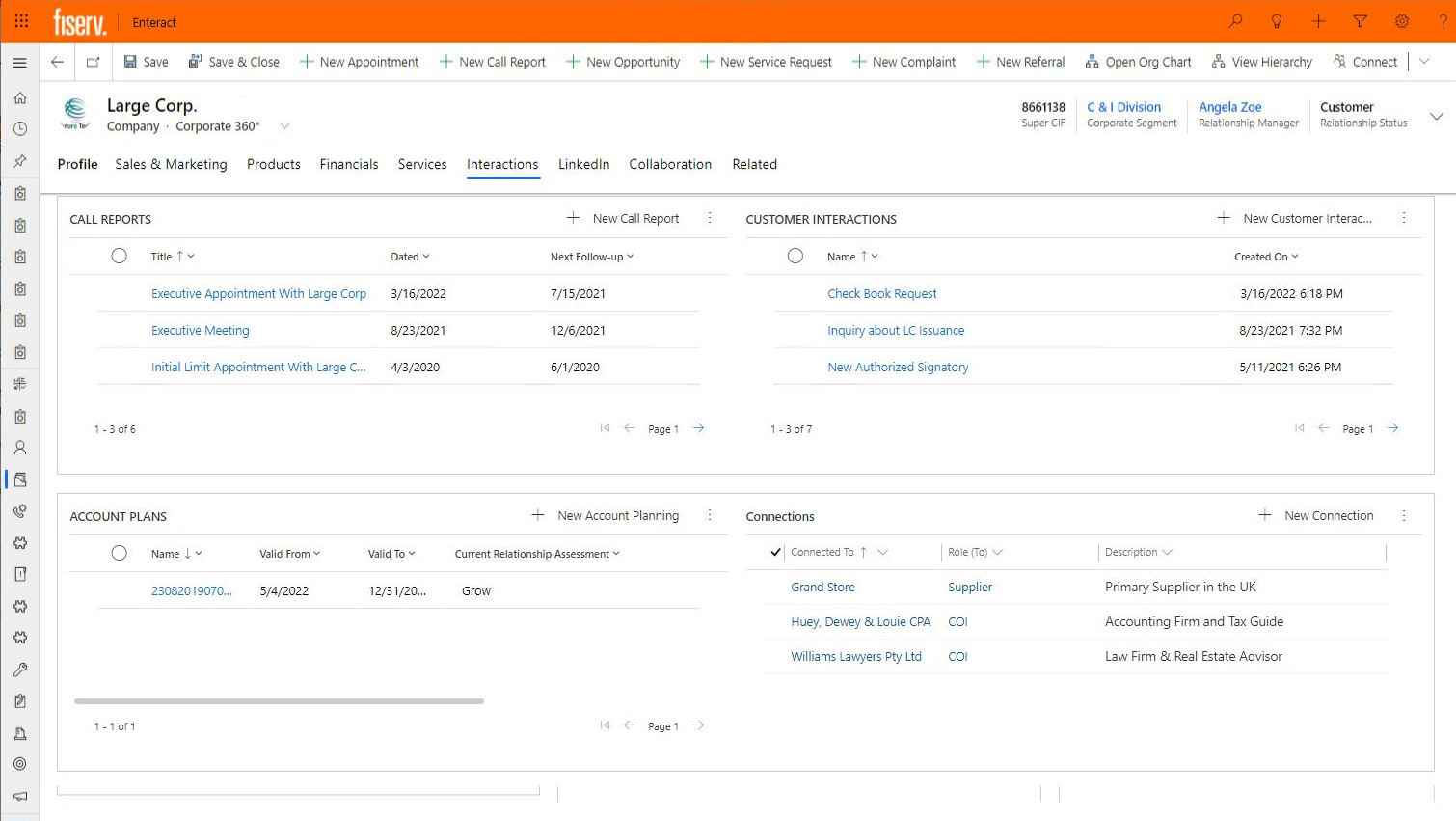

Provide seamless experiences to clients with meaningful interaction tracking

Bankers can understand a client’s engagement with the bank and easily review touchpoints from anywhere. Interactions like meetings, phone calls, and service requests are easily monitored, and bankers can also proactively plan activities and call objectives, recording call outcomes for future use.

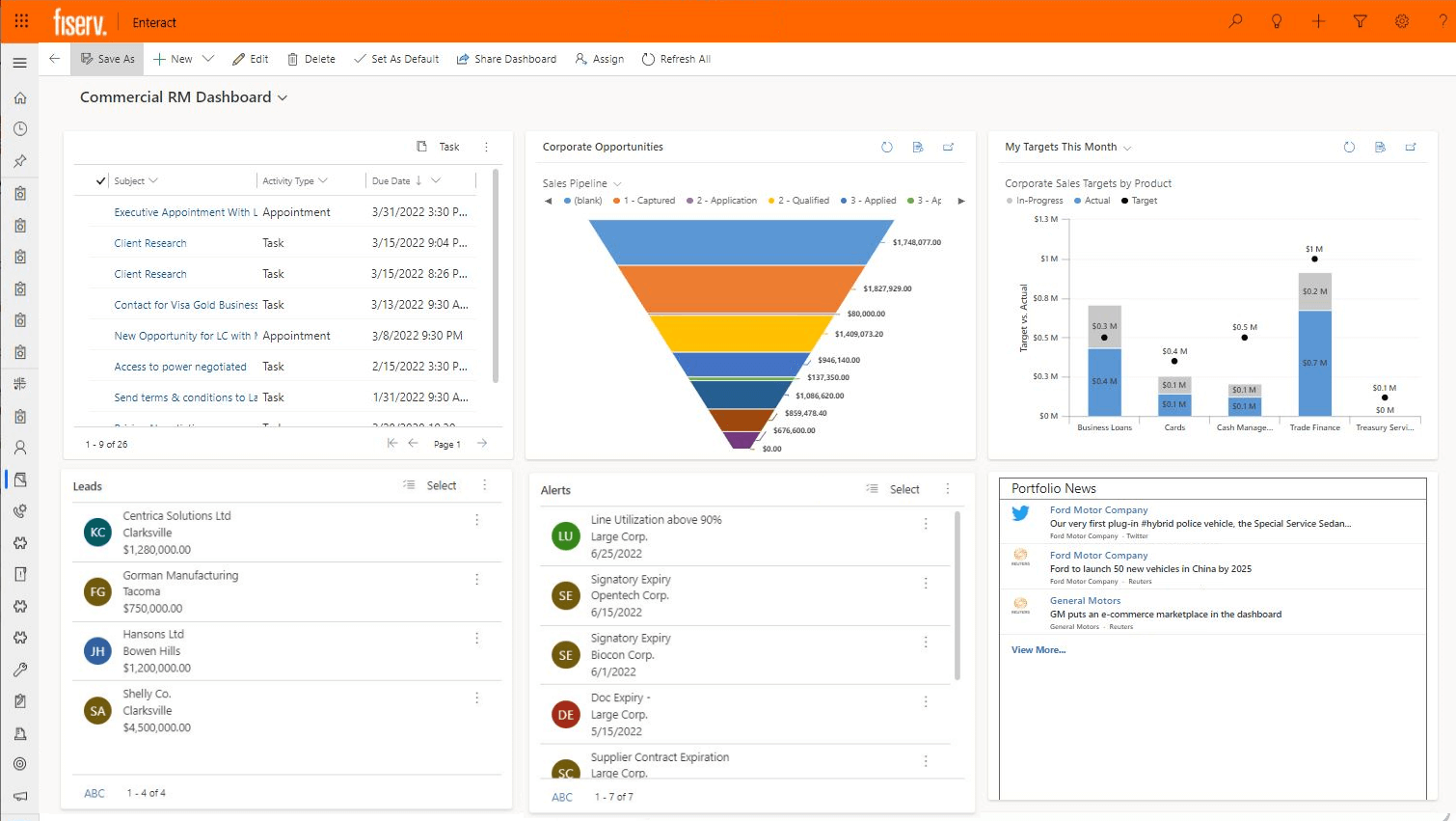

Efficiently enter and manage sales opportunities

Enteract will prefill required info from the customer profile and present required documentation. Bankers are prompted with relevant cross-sell and upsell opportunities.

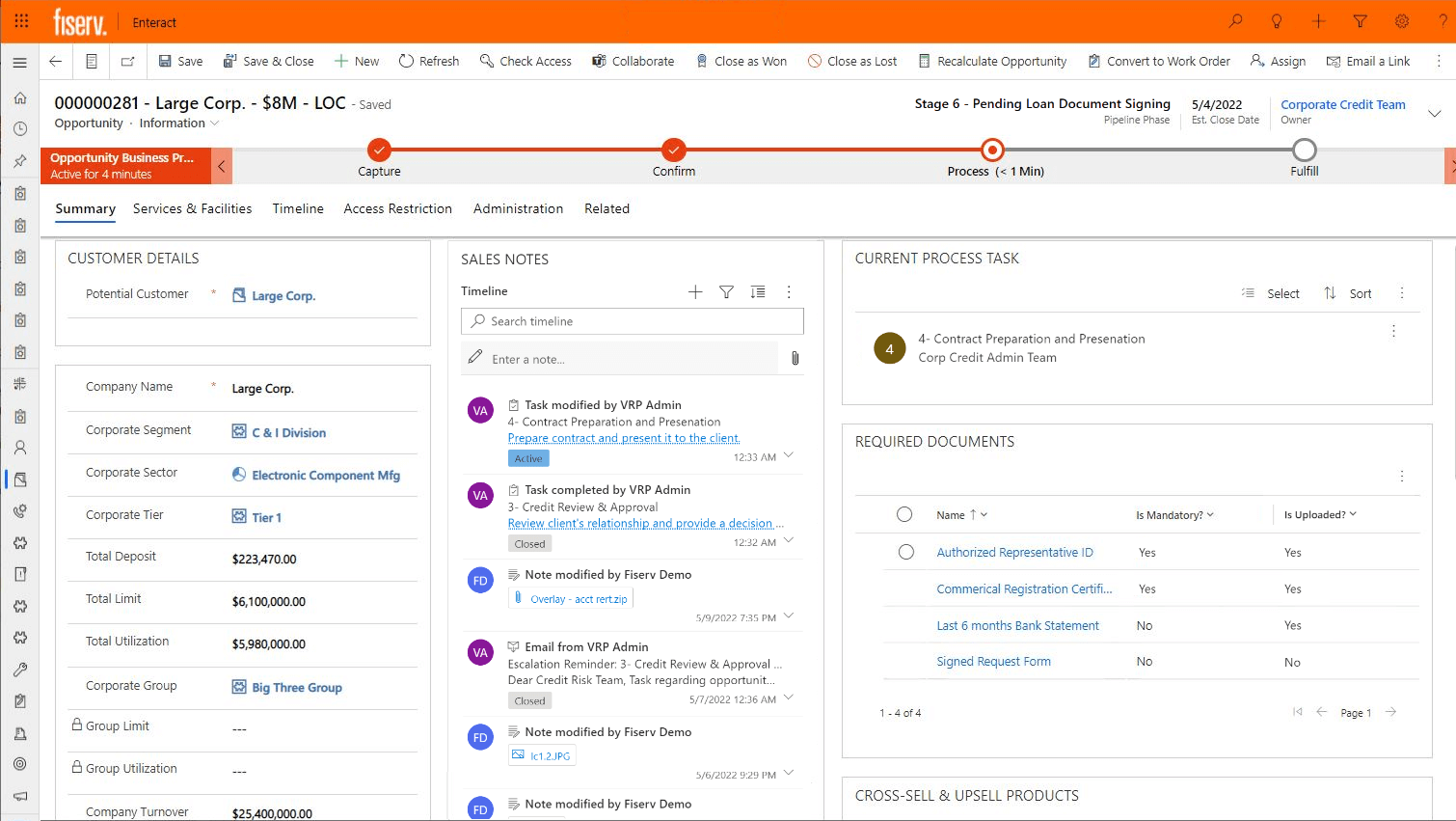

Automate your sales process

Enteract will route the opportunity as needed across your organization and ensure the sale is on track. Reminders, notifications and escalations align the team around clients’ needs. As each team or individual completes the assigned tasks, Enteract updates the pipeline stages and probability and tracks duration of each sales stage to ensure accurate and reliable sales reports as well as monitoring of aging and overdue sales metrics.

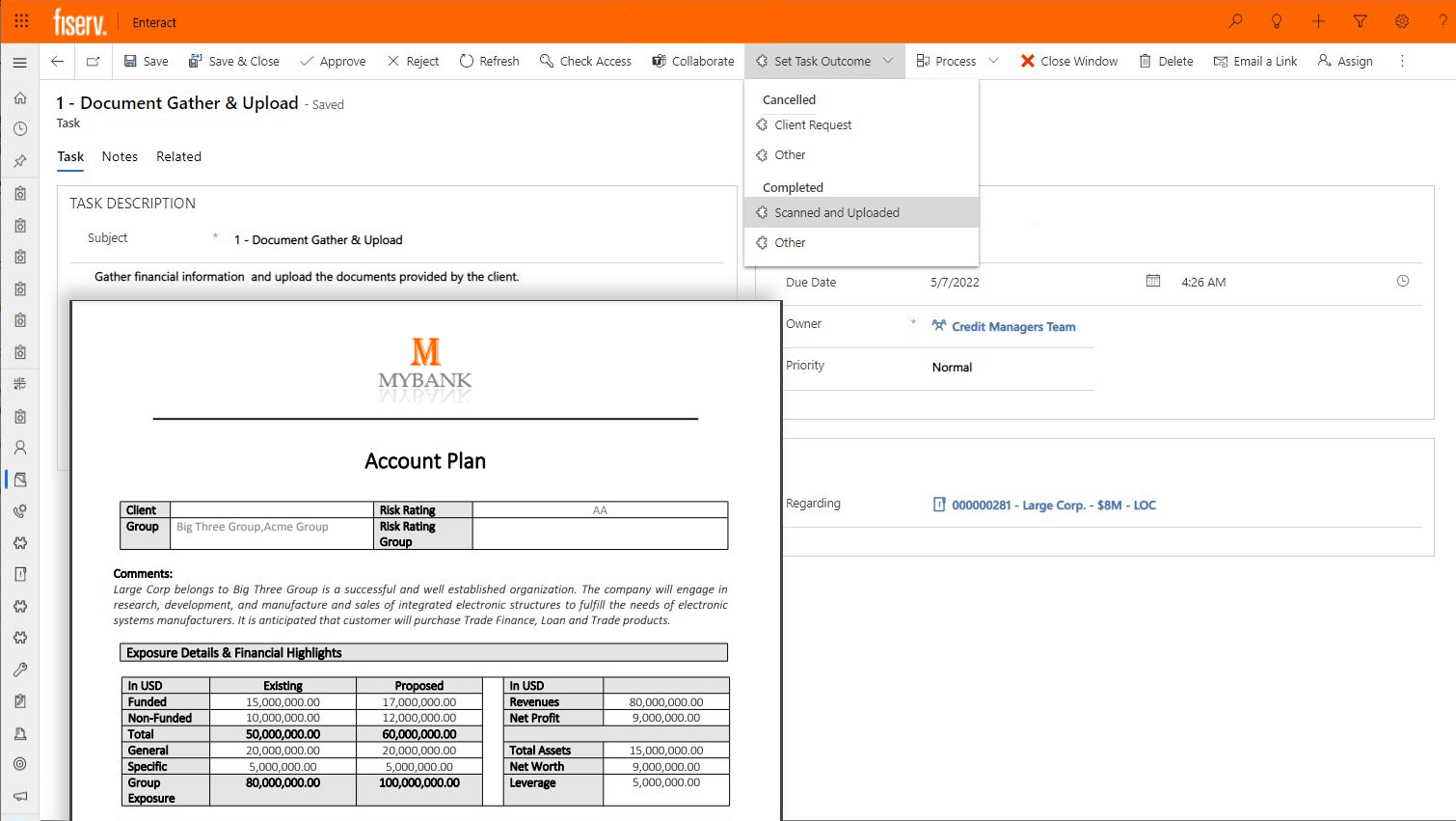

Intuitive workflow features keep sales processes moving

As opportunities progress through defined sales processes, decisions are recorded and tasks are routed. Each process contributor is notified of required actions and due dates.

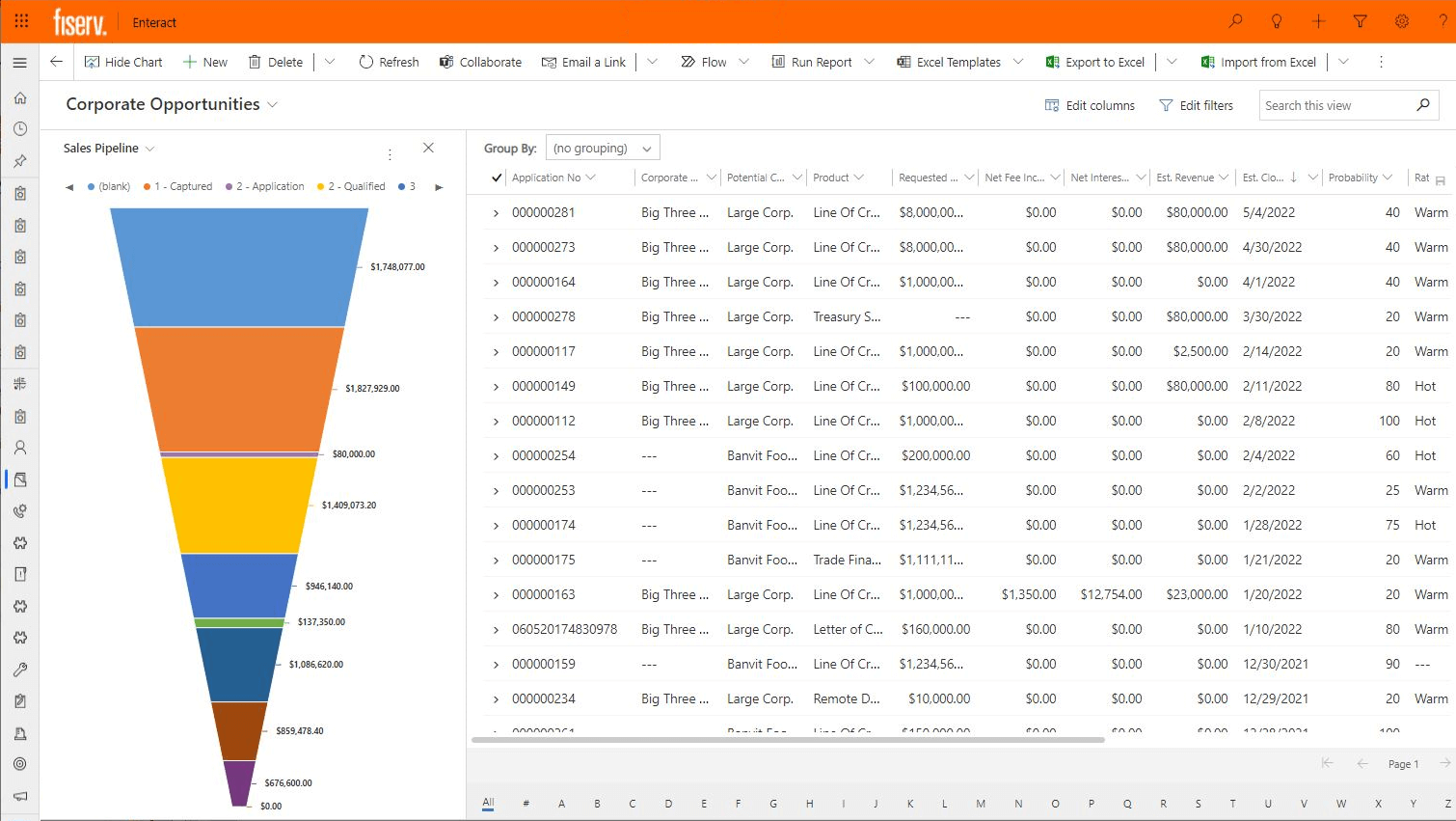

Comprehensive pipeline visibility makes it easy for managers to inspect what they expect

Drill-down dashboards allow managers to efficiently navigate pipeline information by product type and by team to manage performance against goals, anticipate loan funding needs and determine actions to influence key opportunities.